Investment Management

While many advisors outsource their investment management services to other parties, we build and manage our portfolios in-house. We believe that doing so is essential to creating custom solutions for each individual investor. Solutions like greater performance, tax efficiency or liquidity. On top of that, managing portfolios in-house reduces costs for both parties. That’s a win-win.

1.00% AUM fee

-

Account establishment seems straightforward. But given the vast number of account options and rules surrounding taxes and investment options, this step in the investment management process is critical. Below are some of the account types we setup and manage.

Traditional IRA

Roth IRA

Simple IRA

SEP IRA

Trust

LLC

Corporation

Partnerships

Self-Employed 401(k)

Individual Brokerage

Joint Brokerage

UTMA / UGMA

529 College Savings Plan

Other Accounts

-

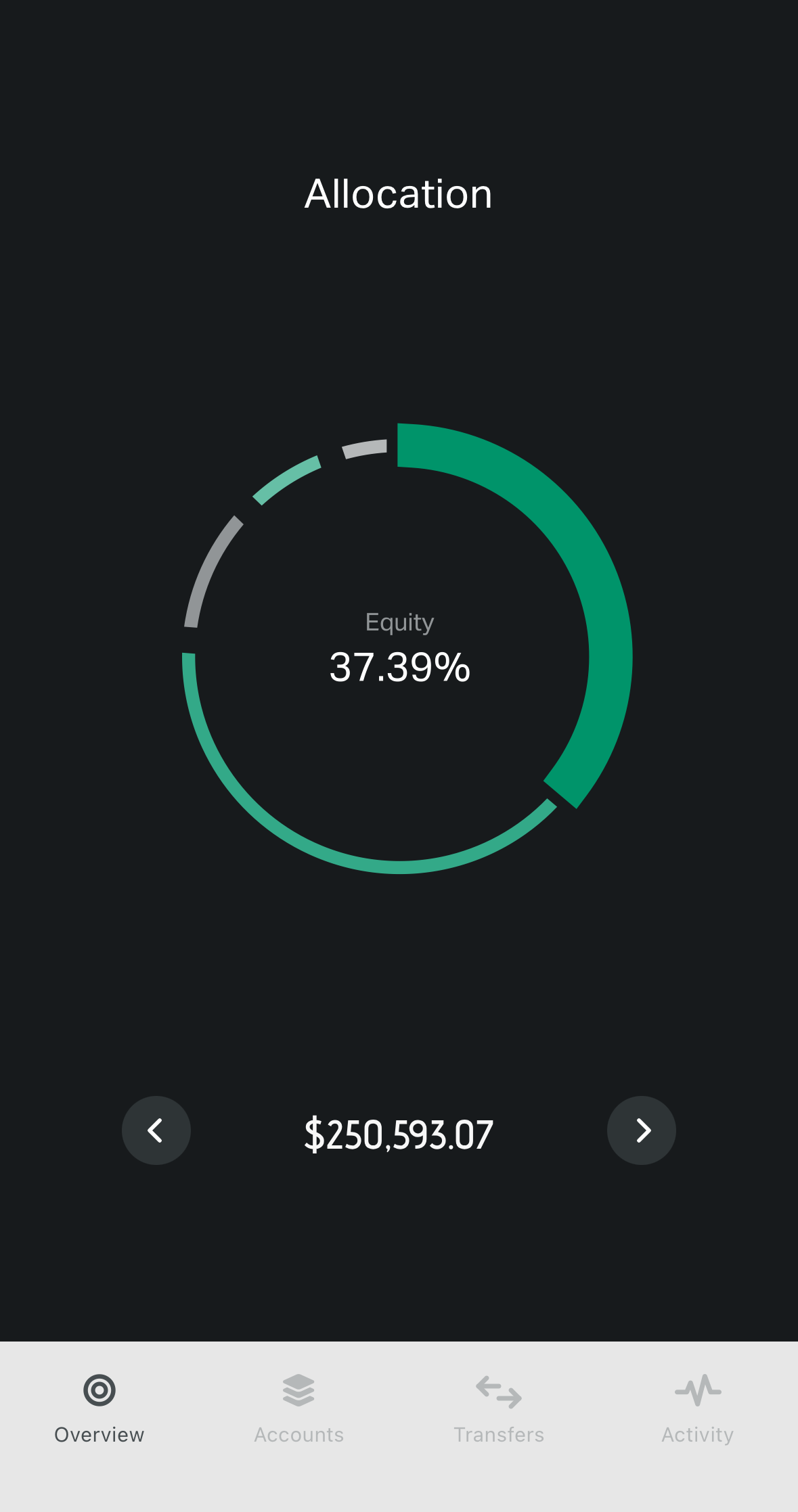

Our portfolios are designed with many features in mind:

1. The portfolios are built to perform by optimizing the relationship between risk and reward. This means that we look at more than just explicit returns. We consider investment downside risk too and believe that avoiding losses is important for growing wealth in the long run.

2. The portfolios are tax aware. This means that they’re built to avoid taxable events in times where performance won’t be sacrificed as a result. Simply put, we don’t believe that you should avoid the prospect of making another dollar just because you’ll be taxed on that new dollar. 70% of $1 will always be more than 100% of $0.

3. The portfolios are liquid. Liquidity refers to the efficiency or ease with which an investment can be converted into ready cash without affecting its return at the time of withdrawal. We build our portfolios to be able to distribute cash quickly, without taking a hit on your return. -

Tax loss harvesting is the strategy of selling an investment at a capital loss to offset the selling of another investment at a capital gain, thus reducing the total amount of tax owed. This is just one more investment management strategy that incrementally improves your wealth in the long run.

-

Tax gain harvesting is when you realize a capital gain on your investment, deliberately. The purpose of tax gain harvesting is to increase your cost basis so that when you eventually sell a large amount of your investments, you have fewer capital gains tax to pay in the future. The idea is to realize taxes at a point when tax rates are more favorable. Because, like it or not, taxes get paid. Paying them earlier at a more favorable rate can be beneficial.

-

An account rollover occurs when you move the investments from one account into another account of the same tax status but of different governance.

For example, a traditional IRA and a tax-deferred 401k have the same tax-deferred status. But each account has different governance around their contribution limits, investment options, withdrawal options etc. Depending on your situation, there are a lot of benefits to holding one over the other and an account rollover may be a good strategy.

-

Roth conversions are a method of replacing tax-deferred investments with tax-exempt investments. Doing so creates tax in the year the strategy is implemented but it eliminates any further taxes on future gains. This can be an incredible tool as it completely eliminates taxes paid in your retirement years.

-

If you have a 401(k) or 403(b) as part of your workplace benefits plan, we can help you make an investment selection that aligns with your risk while optimizing the potential return you will make over the life of your career.

According to the Investment Company Institute, at year-end 2019, 31.3% of 401 (k) assets in its database were invested in target-date funds, with 90% of employers offering them as the default option. If you aren’t familiar with target-date-funds, Abbit is a great resource to learn more.

Though target date funds could be an appropriate investment option for your 401(k) or 403(b), defaulting into a target date fund unintentional could deliver lackluster results over the years. It would be beneficial to explore all of your investment fund options.

-

Other services include:

Safe withdrawal rate analysis / income stream analysis.

Selecting more efficient investment options.

Managing an investment account for your business to create additional income.

Providing market commentary on a regular basis.

Offer perspective on outside investment holdings as an asset class (real estate, cryptocurrencies, private equity, etc.)

A whole lot more.